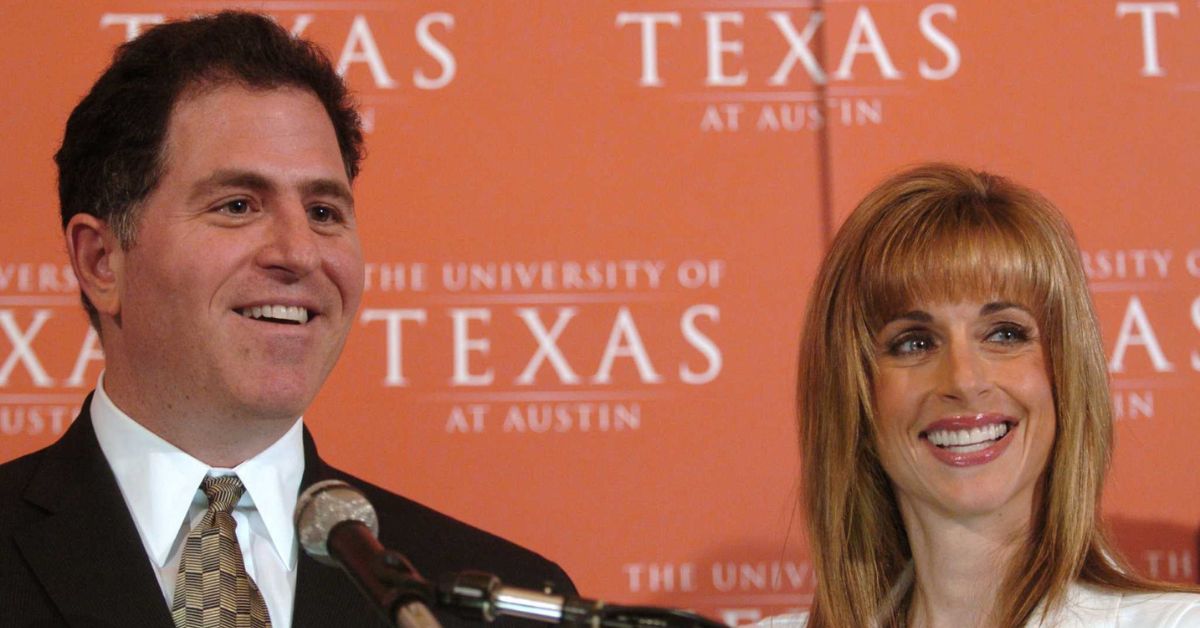

The announcement landed with the kind of thud that stops even jaded reporters mid-scroll. On Giving Tuesday, Michael and Susan Dell revealed a $6.25 billion pledge yes, billion with a “b” aimed at nudging 25 million American children to open the new federally created “Trump Accounts,” a set of child investment accounts baked into President Donald Trump’s tax-and-spending package signed into law this past July 4.

If the number feels unreal, you’re not alone. Gifts of this size almost never appear in the philanthropy world. A single commitment exceeding $1 billion is historic; $6.25 billion to one youth-oriented program is almost without precedent. And yet, here we are, squaring the enormity of the donation with a policy tool so new that the U.S. Department of the Treasury hasn’t even launched it yet.

What the Dells Are Actually Funding

Michael Dell—whose net worth Forbes pegs at roughly $148 billion—said the idea is to spark generational optimism by literally giving kids something worth saving for. The Dells will drop $250 into each eligible child’s account, targeting ZIP codes with median family incomes below $150,000. Treasury is expected to roll out the program July 4, 2026, mirroring the nation’s 250th Independence Day.

Under the law, Treasury will also fund each account with a $1,000 federal deposit for children born between Jan. 1, 2025, and Dec. 31, 2028. Families of older children can opt in and contribute on their own, though they won’t receive the federal seed deposit.

All funds must be invested in broad index funds—essentially mirroring the U.S. stock market, not actively managed products. That requirement aligns with research from the U.S. Securities and Exchange Commission (https://www.sec.gov) and other agencies showing index investing is a low-cost, long-horizon-friendly approach.

When each child turns 18, the money can be used to pay for education, purchase a first home, or start a business. In concept, it’s a cousin of “Baby Bonds,” the long-debated policy of giving children a financial foundation tied to national economic growth.

Why Philanthropists See an Opening

The Dells aren’t the only boldface names behind the program. Venture capitalist Brad Gerstner—also founder of Invest America Charitable Foundation—helped push the legislation through Congress and is advising Treasury on implementation. His point is blunt: if market growth built America’s top fortunes, why shouldn’t future generations—especially low-income kids—get a shot at compounding wealth, too?

Gerstner calls the accounts “a unique platform” that could unlock large-scale giving precisely because the government handles the infrastructure. “We need to include everybody in the upside of the American experiment,” he said. Otherwise, he argues, faith in a market-driven democracy erodes.

It’s hard to ignore the data backing his claim. As of 2022, only 58% of U.S. households owned stocks or bonds, per SEC research, and the wealthiest 1% held almost half of all stock value. The bottom 50% held just 1%. The gap isn’t closing; it widens every cycle.

The Poverty Puzzle the Program Won’t Solve

The elephant in the room is timing. Child poverty in the U.S. ticked up in 2024, with roughly 13% of children living in poverty according to the Annie E. Casey Foundation. Many economists tie that increase to the country’s lack of supports for new parents—things like paid leave, accessible childcare, and consistent nutrition assistance.

And here’s where the picture turns messy: the same legislation that created Trump Accounts reportedly includes cuts to Medicaid, SNAP, and childcare subsidies. Those reductions, researchers warn, may deepen hardship for the very families whose children these new accounts are supposed to uplift. An investment at age 18 doesn’t pay for groceries at age three.

Even Ray Boshara, a widely respected policy advisor at the Aspen Institute, acknowledges the contradictions. But he also sees the long runway. Comparing Trump Accounts to the early versions of Social Security and the Affordable Care Act, he argues that big policies usually start imperfectly and get refined over time. “It’s a down payment on a big idea,” he said.

How the Money Will Flow

Here’s a quick breakdown of how the Dell pledge interacts with Treasury’s program:

| Component | Amount | Who Receives It | When |

|---|---|---|---|

| Federal seed deposit | $1,000 | Children born 2025–2028 | At account creation |

| Dell Foundation contribution | $250 | Children in ZIP codes under $150k median income | After program launch, July 4, 2026 |

| Family contributions | Flexible | Any participating child | Anytime |

| Investment structure | Index fund | All accounts | Ongoing |

| Withdrawal allowed for | Education, homebuying, business | At age 18 | — |

Treasury is expected to provide program rules in 2026. For updates, the agency typically posts new program guidance at https://home.treasury.gov, which is where formal rulemaking documents will likely land.

Why This Matters for Markets—and Families

If 25 million accounts are opened and seeded—even modestly—this becomes one of the largest collective investments in American children in history. A child with $1,250 invested at birth, earning average long-term stock-market returns, could see that grow to roughly $5,000–$6,000 by age 18. Add even small monthly contributions from families or employers, and the number grows quickly.

Of course, the flip side is equally real: investment accounts don’t fix structural gaps in childcare, wages, or healthcare. They are long-horizon tools, not safety nets. The value only materializes in adulthood.

Still, the Dells insist the symbolic value is part of the point. “We want these kids to know their communities care,” Susan Dell said, framing the gift not just as capital but as confidence.

Because the dollar amounts and program details are extraordinary, here’s what can be confirmed through public sources:

- The child investment accounts were indeed included in the president’s July 4 tax-and-spending bill; however, full program rules have not been released by the Treasury as of this writing.

- The Dells’ philanthropic record—$2.9 billion since 1999—is documented through the Michael & Susan Dell Foundation’s public disclosures.

- SEC data on household stock ownership is publicly available.

- Child poverty figures are published annually by the Annie E. Casey Foundation.

- Treasury has not yet published operational guidance for “Trump Accounts,” so some launch details remain dependent on future rulemaking.

Readers should note that until Treasury posts formal rules, operational aspects of the program could evolve.

Historic gifts rarely land with this kind of clarity: a massive sum, a specific target, and a brand-new federal platform poised to rewire how millions of kids interact with the financial system. Whether “Trump Accounts” become a lasting pillar of economic mobility—or fade into the long list of ambitious but underfunded federal programs—will depend on uptake, contributions, and political appetite.

For now, the Dells have thrown down a philanthropic gauntlet. Their $6.25 billion isn’t just a donation; it’s an invitation for the country to rethink what it means to stake a child’s future on the market that has powered American wealth for generations.

FAQs

How much are Michael and Susan Dell donating?

They’ve pledged $6.25 billion to seed 25 million child investment accounts.

What are “Trump Accounts”?

They’re new child investment accounts established in federal law, expected to launch July 4, 2026.

Who gets money automatically?

Children born between 2025 and 2028 receive a $1,000 federal deposit. The Dell contribution targets lower-income ZIP codes.

What can the funds be used for at age 18?

Education expenses, a first home purchase, or starting a business.

Do these accounts reduce child poverty now?

Not directly. They’re long-term investment tools and do not replace programs like Medicaid or SNAP.